The best of each worlds: Some of the engaging features of stablecoins is the fact that it supplies you with the best of each worlds, fiat, and crypto. The lack of stability and extreme volatility have been usually cited as the biggest causes holding back crypto adoption. However, stablecoins utterly mitigate this subject by guaranteeing price stability. Nonetheless, regardless of this, it’s nonetheless based mostly on blockchain know-how and gives you the benefits of decentralization and immutability inherent in blockchain know-how.

DApps: Decentralized Finance (DeFi) has been touted as the way forward for finance and certainly one of the largest drivers of blockchain adoption. Probably the most wonderful features of these dApps occurs to be their composability. In different words, you’ll be able to mix completely different DeFi products/functions with ease. As such, stablecoins will be simply built-in with DeFi apps to encourage in-app purchases and build an inner financial system.

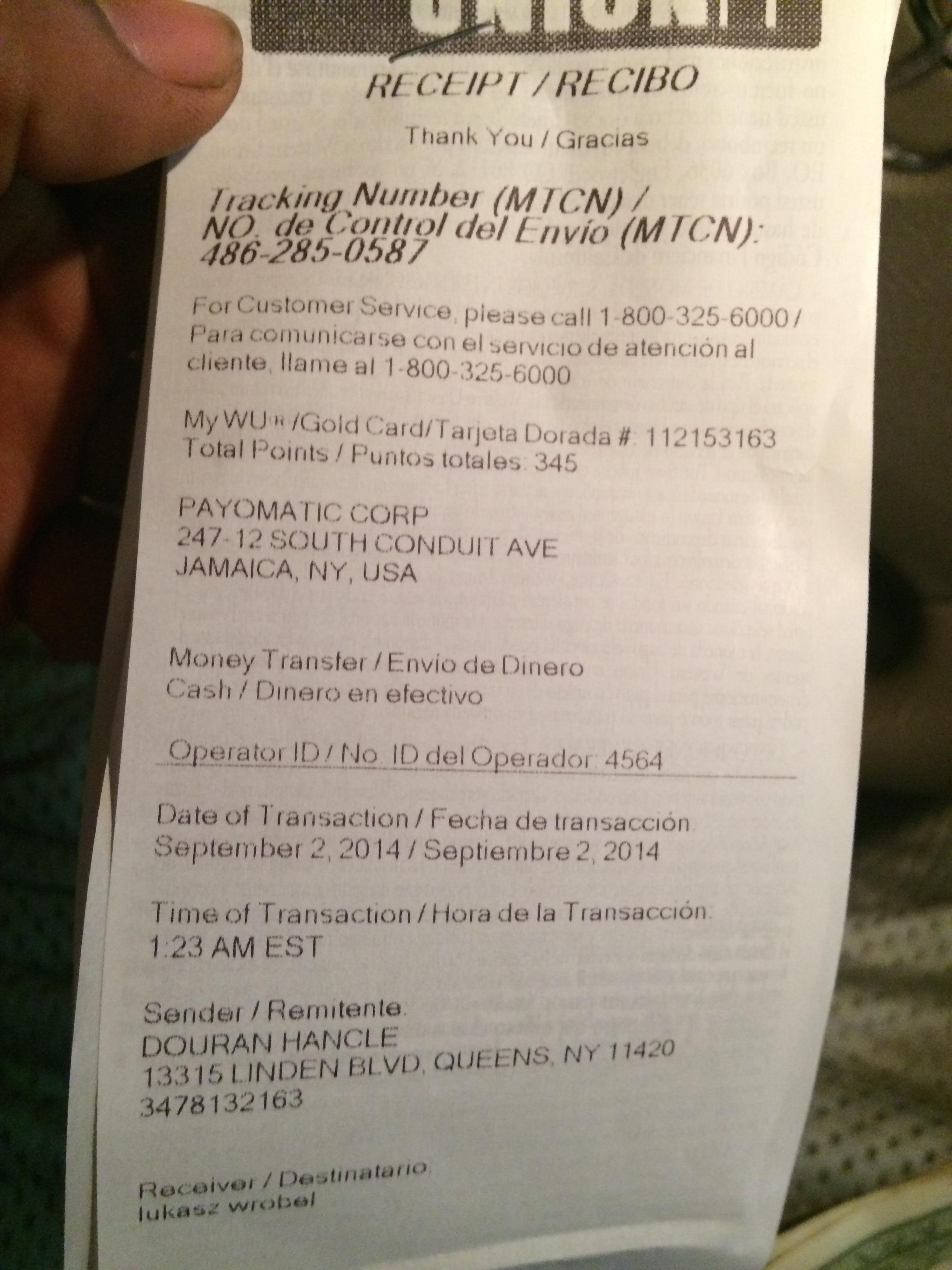

Sooner remittance: Stablecoins allow you to conduct cross-border payments and remittances at a much quicker fee.

AndSim/iStock /Getty Photographs Plus/Getty Pictures Most robo-advisors do not let you decide which securities to invest in. That is because they’ve subscribed to a managed-portfolio-solely strategy, eschewing self-directed trading totally. Nevertheless, Axos Managed Portfolios, owned by Axos Financial institution, is one of the few robo-advisors on the market with both automated investing and direct trading, permitting you to have a managed portfolio and make your individual commission-free trades on the identical platform (not to say also common banking services). This consists of the ability to commerce stocks and alternate-traded funds. You open these accounts separately, but everything will be in a single place.

Once you see a headline or btc account a tweet about some preposterous sum being spent on an NFT, it’s easy to become bewildered over how absurd that buy would be for you. What’s easy to overlook is that very costly things are almost exclusively purchased by very wealthy individuals — and very rich individuals spend so much on standing symbols.

The protocol is a distributed, time-stamped ledger of unspent transaction output (UTXO) transfers saved in an append-only chain of 1MB information blocks. A community of mining and financial nodes maintains this blockchain by validating, propagating, and competing to include pending transactions (mempool) in new blocks. Financial nodes (aka “full nodes”) receive transactions from different community participants, validate them towards community consensus rules and double-spend vectors, and propagate the transactions to other full nodes that also validate and propagate. Valid transactions are sent to the network’s mempool ready for mining nodes to confirm them through inclusion in the subsequent block.